is there any relief for property taxes

The Taxpayer Relief Act provides for property tax reduction allocations to be. Are there any new Covid 19-related property tax breaks in the US.

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

The following information can assist those needing property tax relief in Utah.

. For people hit financially by the pandemic a 500 tax bill can be too much. Senior Citizens Homestead ExemptionAn annual tax exemption available for people who are at least 65 years old and own a record of the property or have an equitable or legal interest not. You will need to record a description of the damage caused by the disaster to your property as well as provide information on your total annual household income before taxes.

Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your. As used in this chapter. The applicant will need to be the owner of the real estate property according to the assessors records.

This credit amount is listed on the property tax bill below the Net Assessed Value. Of course the homeowner must have been delinquent on paying their property taxes. COVID-19 is still active.

½ tax due or max. Homeowners or renters may qualify for a Property Tax Refund depending on income and property taxes. Commissioner of the revenue means the same as that set forth in 581-3100For purposes of this chapter in a.

The net amount of loss reported on. School Levy Tax Credit. Theyll get a tax credit of 1440 7200 x 20 A basic-rate taxpayer will pay 840 -.

Is there any relief for property taxes. State leaders have recognized this hardship and created property tax relief programs in response. It is provided for reference and is not an exhaustive list of resources.

Approval of mortgage or trust deed holder. The State of Maine provides a measure of property tax relief through different programs to qualified individuals. Personal Property Tax Relief 581-3523.

For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that. Of 1110 whichever is less Indigent Deferral 59-2-1802. LightRocket via Getty Images.

While some are applied at a local level others may be applied for through. The American Rescue Plan Act of 2021 passed by the US. To get a Massachusetts property tax exemption for seniors you need to be 65 or older before the end of the year.

New Yorks senior exemption is also pretty generous. Here is this weeks question. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

Less 20 tax reduction for remaining finance. Stay up to date on vaccine information. All taxable real property in Wisconsin qualifies for the School Levy Tax Credit.

Local Property Tax Relief Programs. The economic impact of Covid-19 has had such far reaching implications that even real estate taxes have started to have some relief provided. Senior citizens with a.

Covid19njgov Call NJPIES Call Center for medical information. This exemption is worth 700 and married people may be entitled to one. Senior Citizens Property Tax Deferral Program.

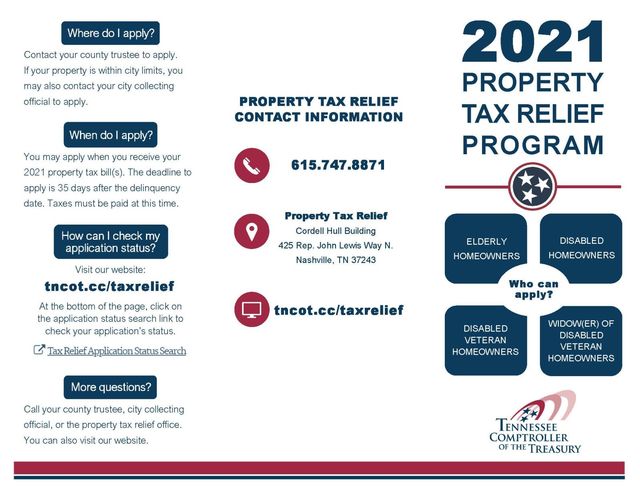

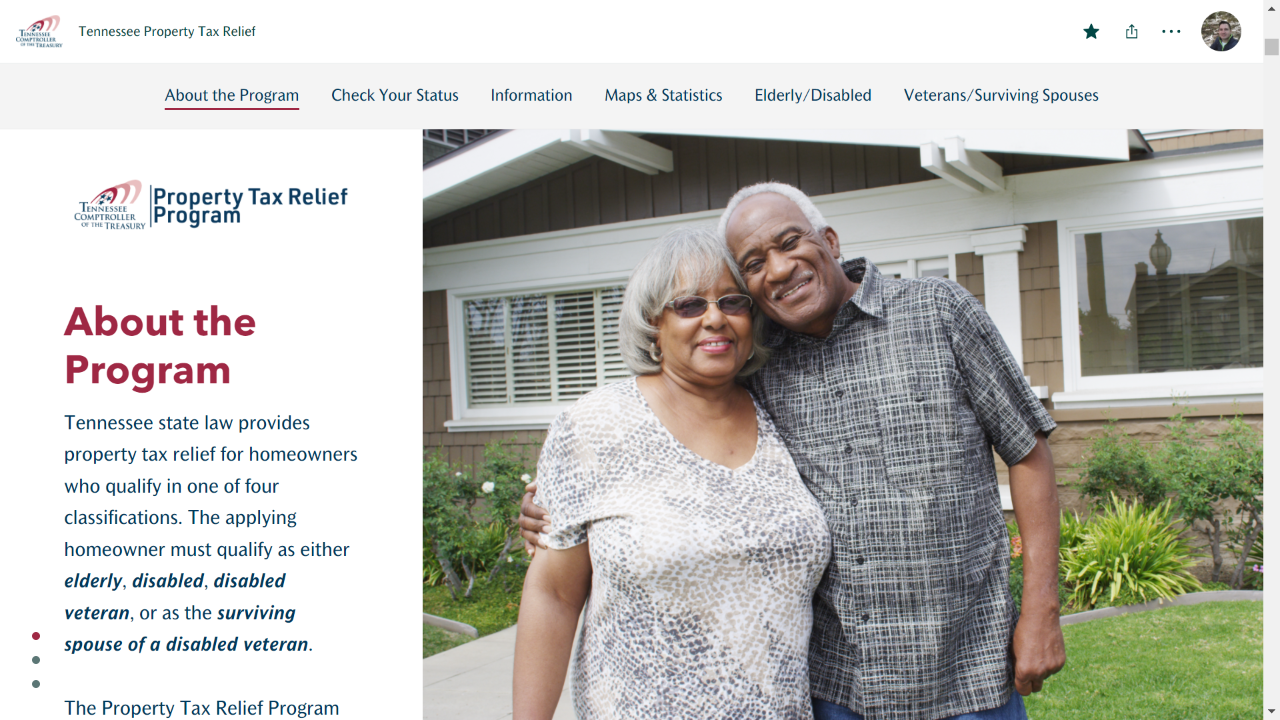

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Are There New Property Tax Discounts In The U S Related To Covid 19 Mansion Global

Property Tax Relief Polk County Iowa

Gov Little Signs Property Tax Relief Legislation Into Law Ktvb Com

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Senior School Property Tax Relief City Of Harrington Kent County Delaware

Illinois Property Tax Relief Home Facebook

Property Tax Relief Propertytaxes Law

Nearly 2 Million Nj Households Eligible For Property Tax Relief Program Morristown Minute Newsbreak Original

The Batinick Plan For Pension Reform As A Foundation For Property Tax Relief

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5SS6QC6XS5B7NPRDZOIDRR4LZI.JPG)

May 7 Election Could Give Texas Homeowners Some Property Tax Relief

Property Tax Relief Grant News Village Of Mount Prospect Il

Property Tax Relief How It Works Credit Karma

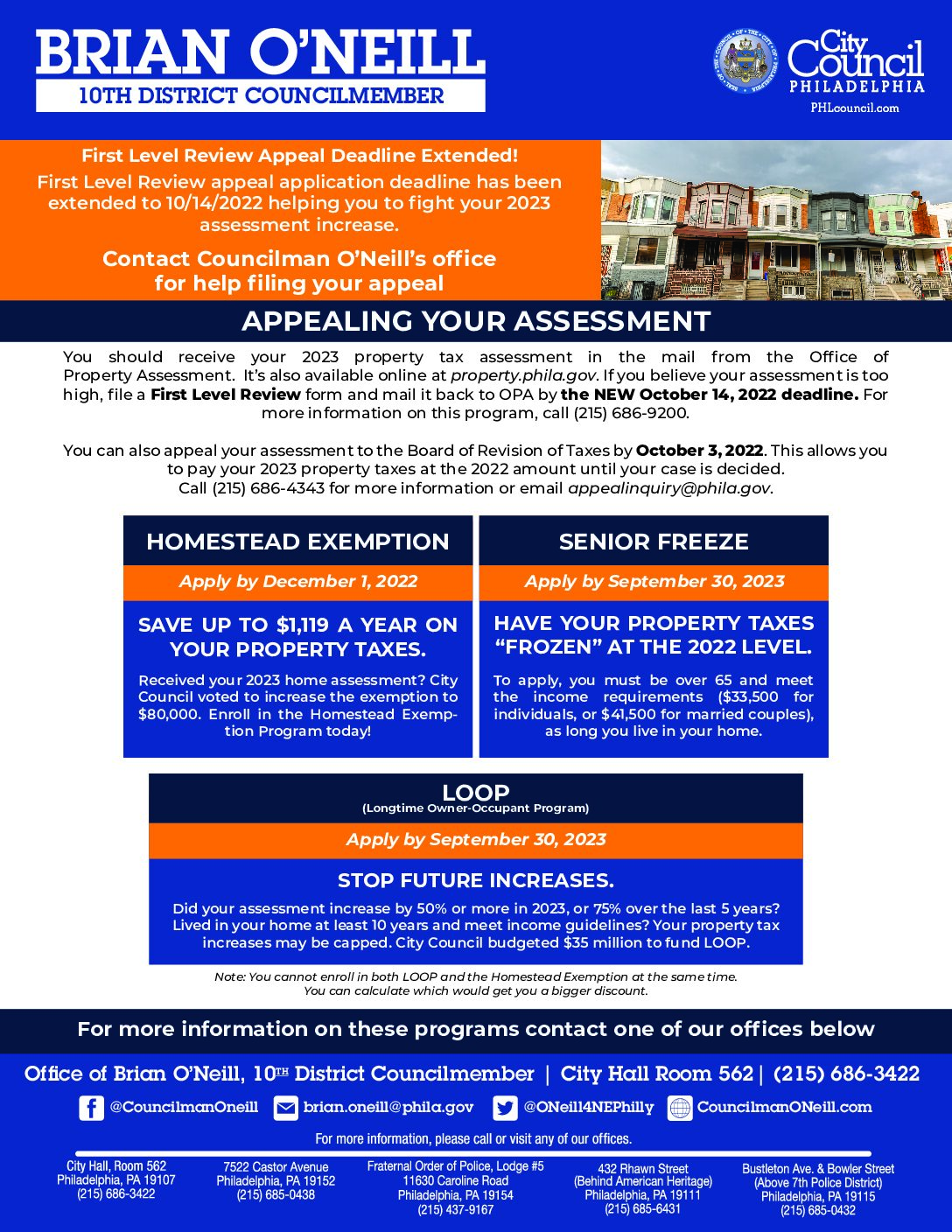

Councilmember O Neill Announces Property Tax Relief Measures Philadelphia City Council